“People today are in danger of drowning in information; but because they have been taught that information is useful, they are more willing to drown than they need be.If they could handle information, they would not have to drown at all.”

Idries Shah

We are drowning in information, but who is to blame for this situation ?

Good old books are not the main problem now days.

Not everyone gets their information from the tattooed skins of dead tree`s anymore.

The blame surely must lie with the electronic boxes in our houses called computers.

The beginnings of the computer, lead to packet switching networks like ARPANET…which then went on to more research at CERN and a British computer scientist developing the computer science network.

Since the mid 1990`s, the internet has led a revolution in information and this of course has its down sides.

Now this has led to several problems.

The first and less obvious, and we all suffer from this.

A large amount of the “information” is pure dross and only fluffy “entertainment” using the term loosely.

And we get side tracked into wasting our time looking at, evaluating or even commenting on it.

And now days people will also find time to waste with “tweets” and snap chat etc..

But the central theme of Ample Property Solutions is information that is relevant to wealth building.

And that leads to the next problem.

Everyone and his dog thinks they have relevant information on wealth creation that is pertinent.

And some do.

But this can cut both ways, especially in a sea of information propagated by the internet.

The core of our strategy is essentially simple.

Invest in properties the right way backed by specialists Australia wide, helping you too safely build a property portfolio over time.

And our staff, as well as the independent experts we use, can help our clients every step of the way.

Do other companies do this ?

Of course.

Too various levels of integrity and professional competence.

But the formula(if thats the right word) is not the hard bit.

Its the implementation which is.

That`s why the path of true wealth creation is built on the back of other peoples skills and others peoples money(the banks).

But my uncle Ed thinks he has a good idea about investing and he is pretty confident.

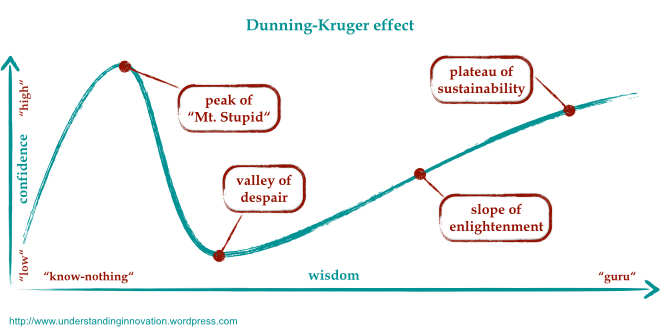

Which leads to something interesting called the Dunning–Kruger effect which is a cognitive bias in which low-ability individuals suffer from illusory superiority, mistakenly assessing their ability as much higher than it really is.

Uncle Ed, or the people around the coffee machine at work might be suffering from the Dunning–Kruger effect.

“The fool doth think he is wise, but the wise man knows himself to be a fool” Shakespeare

There are many different strategies for long term wealth creation which makes it hard to concentrate and narrow the selection down to the core, but lets try anyway.

Saving your money in a bank or super fund. But we are talking about long term wealth creation investment, not just parking your capital.

Which leaves you with “investing” in shares or investing in real estate.

Low interest rates are pushing down the yield on fixed income assets, including bank deposits and bonds, and as a result investors have crowded into the riskier sharemarket to tap into the average 5 per cent dividend yield delivered by the market.

The banks think so highly of stocks that they will lend you money to invest in their own companies. Of course I am joking.

They don’t and for good reason.

They know how dangerous it is to invest in stocks.

What better warning sign would future investors need than the banks own reluctance in investing in themselves ?

We will always need houses for our growing population but we will not always need shares.

Food and shelter are base human desires and the wealth is in both, but we are more interested in a large entity like a house than buying a food business or buying shares in a food retailer.

The true and tried wealth creation methods and wisdom of the past, leads us to the investment opportunities of the future.

You must take action now, not tomorrow, to start your wealth creation for your families future.

Contact us today HERE for a free consultation or to book for our next Free Property Seminar ! Burwood- Tuesday-4th October- 2016 at 6.30 pm.