I am wiser than this man, for neither of us appears to know anything great and good; but he fancies he knows something, although he knows nothing; whereas I, as I do not know anything, so I do not fancy I do. In this trifling particular, then, I appear to be wiser than he, because I do not fancy I know what I do not know.

—attributed to Socrates, from Plato, Apology

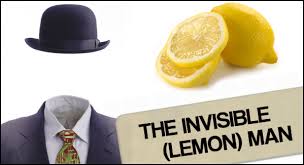

How do you segue from McArthur Wheeler, a bank robber who covered his face with lemon juice, to investing in property in Australia ?

Please allow us to expand on the worlds worst bank robber.

When you are in a shop and you are about to purchase something inconsequential like a piece of fruit, do you do a great deal of research beforehand ?

Not really.

You base your purchase on previous experiences, your likes and dislikes, and prices of course..

So what does that have to do with real estate investment for long term wealth creation ?

Everything!

Now back to our bank robber.

Wheeler had learnt that lemon juice could be used as “invisible ink” (that is, the old childhood experiment of making the juice appear when heated); he therefore got the idea that unheated lemon juice would render his facial features un-recognizable.

When he was caught after several bank robberies and shown footage of himself, he expressed surprise and stated “But I wore the juice” …

And based on this bizarre case…Dunning and Kruger, in 1999 wrote “Unskilled and unaware of it: How difficulties in recognizing one’s own incompetence lead to inflated self-assessments.”

“The Dunning–Kruger effect is a cognitive bias in which low-ability individuals suffer from illusory superiority, mistakenly assessing their ability as much higher than it really is….This overestimation occurs, in part, because people who are unskilled in these domains suffer a dual burden: Not only do these people reach erroneous conclusions and make unfortunate choices, but their incompetence robs them of the metacognitive ability to realise it.” source

Now there are two “areas” of investor ignorance.

1/Which “vehicle” to place your investment in for the long duration

And in regards to real estate..

2/The right timing and “duration” and location of that investment.

Now of course we are a company which is going to promote the long term investment of excess capital into property.

New property being our favourite suggestion due to the amazing tax advantages as well as lower upkeep costs.

And then using the increase in the value of the property over a length of time, as leverage for another property.

We are not adverse to shares but believe the safest long term wealth creation in Australia at this time, without the volatility of the sharemarket, is real estate.

But we need to base our investment on sound research.

In the “bad old days” of purchasing something like a car for instance, information was asymmetrical between the buyer and the commercial seller.

The commercial seller had all the data at their fingertips..and the consumer did not.

Now days, with the internet, the information is “more” symmetrical between sellers and buyers(investors).

Consumers can do a lot of research into their chosen investment, before speaking to any form of agent or advisor.

The “danger” is, at some point, the investor must not fall into any form of “Dunning–Kruger effect”…

Or, they must become aware that they are in its grasp!

Macro Research

You must be able to review data on state by state and city by city trends which includes public works etc and data from organisations like the Australian Bureau of Statistics ,Population, employment rates, income etc for a top down encapsulation of an area and its projected growth.

Since the GFC in 2009-10, Australia’s economic conditions have provided an environment favourable to property investment with low and stable interest and inflation rates, strong and sustained growth in residential and commercial property prices.

Micro Research.

This is more of a drill down type data accumulation looking at days on market, stock levels, prices and yields which are used for predictions in trends in small localised areas.

Supply can be determined by amount of houses available as well as houses that will shortly be available.

Markets can be in one of the three statuses: over-supply, neutral supply or under-supply.

Vacancy rates also are a great way of judging supply and demand rates.

The largest investment consumers will ever make is in property !

At the end of the day, how much valid research will you do before you step into this market ?

Does everyone have the time and contacts to find out where the best investment properties right now.

Of course not.

Which is better solution ?

Let a company like Ample Property Solutions guide you at every step of the way using all our research and team of experts.

Or

Use google and step into the abyss.

Remember the man with the lemon juice on his face 🙂

We are here to help you right now.

For an obligation free meeting with one of our advisors contact us today HERE

“Doing all we can to keep the Australian dream alive”

The Building blocks of success