Poverty and Marshmallows ?

What is a noun that has three syllables, and means different things to different people ?

And none of us “wants to experience it”.

Poverty-pov-er-tee.

“The state or condition of having little or no money, goods, or means of support; condition of being poor.

Synonyms: privation, neediness, destitution, indigence, pauperism, penury.

Antonyms: riches, wealth, plenty.”

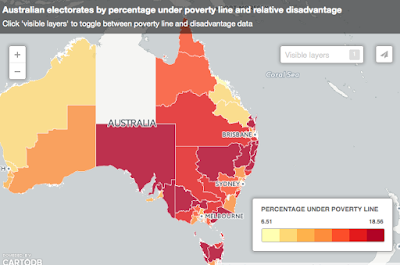

Two million, six hundred thousand Australians now live in poverty.

Try and get your head around 13.9 per cent of the total population, living in poverty.

Many of them children.

Do many of us really know what its like ?

Or will some of us come face to face with it in our future ?

It all depends on what choices we make now !

Some people measure poverty using parameters like entrenched disadvantage, criminal convictions, unemployment, no internet access, domestic violence, lack of qualifications and young adults not fully engaged in work or study disability, low education and child maltreatment, family violence and psychiatric admissions etc.

source

|

| Australian electorate living under poverty |

“The 2011-12 ABS data suggest that around 2.6 million … Australians live under the poverty line. Of these, almost one-quarter (618,000) are dependent children aged less than 25 years of age and 494,000 aged less than 15 years of age.”

source

Now we realise that many keyboard “social warriors” in their never ending, twitter inspired reactions to words like “poverty” will rush to do some form of “virtue signalling” ergo “ To take a conspicuous but essentially useless action ostensibly to support a good cause but actually to show off how much more moral you are than everybody else.”.

Hat tip to the inventor of the term James Bartholomew,The Spectator, 18 April 2015.

So where is this weeks post going ?

How can we segue from poverty, to “investing in property” ?

Simple.

Do most Australians, now days, look at the assets of their parents and say “wow, who would have thought a share portfolio in blue chip shares, sure did pay mum and dad back after forty years”.

Of course they don’t.

But what many do mention, is the bleeding obvious and remark how much “value” the family home has accrued over the years.

No one ever says “the value of the family home after forty years has gone down”.

Because it doesn’t happen.

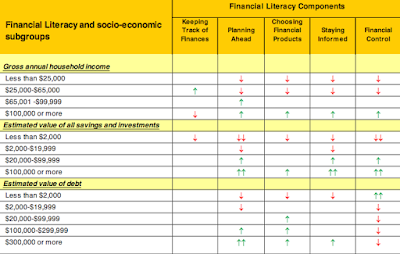

We believe that the most straight forward, tried and true method of long term wealth creation, is through “financial literacy”.

But how do we define that term anyway ?

“Financial literacy is the ability to make informed judgements and to take effective decisions

regarding the use and management of money and is a complex combination of a person’s skills,

knowledge, attitudes and ultimately their behaviours in relation to money.”

And what else do we find in the report by the research arm of ANZ on financial literacy ?

“ Numbers holding high interest savings accounts were steady (47 percent) as were numbers

holding investment properties (19 percent)…. Around three quarters of people had consulted other people for financial advice in the last 12 months. Main sources of advice we re: an accountant (39 percent), friends or family (35 percent), a bank manager or employee (30 percent) and financial planners/advisers (20 percent).

And Ample Property Services, no surprises, believes that financial literacy is primarily built around investing in the right type of new property, which leads to massive tax savings now !

This logically leads to maximum and secure forms of future wealth accumulation, for all our clients.

And ourselves of course !

And many our clients that actually get this, we believe, understand the advantages of looking into the future, and (sometimes) delaying gratification now.

And we end this article on a short note about marshmallows.

To be precise, the Stanford marshmallow experiment.

The purpose of the original study was to understand control of deferred gratification.

For example.

The ability to be able to make a choice to achieve instant gratification now, or wait , and achieve even greater rewards later, develops when we are children.

The children could eat the marshmallow, the researchers said, but if they waited for fifteen minutes without giving in to the temptation, they would be rewarded with a second marshmallow.

Mischel found unexpected positive correlations between the results of the marshmallow test and the success of the children many years later.

In essence, what the researchers found was, their was a correlation between the children who delayed their “in the moment choice”, for the greater reward, and later success in life.

Which is truly amazing.

The choices you make now, with the right team helping you, will effect your future !

Taking action NOW is the key to real wealth building !

Let Ample Property Solutions help you !