The Past – Future and Leverage

Twenty years from now you will be more disappointed by the things that you didn’t do than by the ones you did do.

So throw off the bowlines.Sail away from the safe harbour. Catch the trade winds in your sails. Explore. Dream. Discover.

Mark Twain

I was getting a hair cut today… a number three of course, whilst trading war stories with the barber.

A friend of his had recently sold a house, with a profit of over $150,000.00 in less than one year, and was moving out of the area.

The investor had been forced to sell due to personal considerations but had a history of sound property investment.

And people still ask me why Ample Property Solutions love the power of property for wealth creation.

Where else could the investor have placed their capital, to return such an outrageous amount ?

Ample property would have tried to help this investor, if he had been a client, to keep the property and use the equity wind fall as leverage for another property.

They had used capital growth in another house, to leverage the purchase of this property.

So how do we define the word leverage.

Noun- “the use of a small initial investment, credit, or borrowed funds to gain a very high return in relation to one’s investment, to control a much larger investment, or to reduce one’s own liability for any loss.Does our past history predict our future outcomes.”

The investor used the power of a series of smaller investments, to purchase the house near where I live.

Rented it out for a year, then sold it.

For a massive profit.

Leveraging the increase in value of an equity, and investing that “profit” again, in the right location, at the right time, is the secret sauce that Australians, some of them at least, are learning from our seminars and coaching clinics.

But, you have the greatest probability, when you know where and when to do this.

It was the equivalent of earning the average weekly net wage in Australia, which is about $1000.00, for about 3 years, and saving every cent.

Yet the investor was not actually working, his money was.

Thats the key difference.

What would you rather do, work or have your money work for you.

I did note that the investor had done this before.

Which leads us by the nose to the second part of this post.

Does our past, predict our future ?

There is a yes, no, and maybe coming of course.

Historical data in virtually any field, remains the best way to forecast future trends in nearly every subject.

Look at financial models for instance.

They will find a price and then hedge against fluctuations in the future based on different data points.

The price of an asset is a function of its expected future payouts and risk.

The question should be, does our past, always dictate our future ?

This is more realistic for individual actions.

And the answer is… NO.

By taking small incremental steps, that are towards positive outcomes in the long term, we all can change our future, regardless of whether we are talking fitness, weight loss, learning a musical instrument or wealth creation.

Desire, will and taking action, with no expectation of immediate benefits, is what changes our life.

There are no shortcuts.!

Now Lets look at pensions

The first shift upwards in access to the Age Pension will occur in July 2017 when the Age Pension eligibility age increases to 65.5 years, and then in six-month increments every 2 years, until it reaches the age of 67 years from 1 July 2023.

Now have a look at this convoluted quote from the Australian bureau of statistics.

We are guessing that its trying to show the difference between the initial income and then transition to the pension percentages.

While 1.5 million (46%) of those aged 45 years and over who had retired reported that a ‘government pension/allowance’ was their main source of personal income at retirement, almost 2.2 million (66% of all those who were retired) indicated that this was now their main source of current personal income.

source

The 66% is a frightening level !

How many people would seriously believe that in the future, they would be relying on the lousy pension to survive ?

I bet 66% of the population under 45 years of age would deny desiring to end up living on the pension with no other assets.

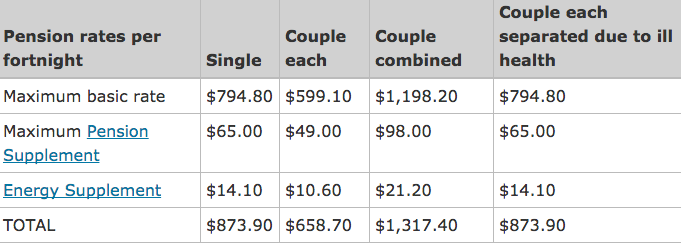

Lets see how much a pensioner makes,adjusted of course if you have assets.

The choice of your future is in your hands.

Ample Property Solutions will guide and educate you to take the right and necessary actions to build a prosperous future.

Ample property Solutions can show you how to leverage the power of real estate investment for long term wealth creation.

Book a free consultation now and also find out how to lower your current mortgage as well as lower your tax !

Contact us TODAY