If a working class Englishman saw a bloke drive past in a Rolls-Royce, he’d say to himself “Come the social revolution and we’ll take that away from you, mate”. Whereas if his American counterpart saw a bloke drive past in a Cadillac he’d say “One day I’m going to own one of those”. To my way of thinking the first attitude is wrong. The latter is right.

Kerry Packer

Give me a B..give me a U give me DGE..and throw in a T…

Its the most exciting thing since toad races in the Queensland outback.

The Medicare levy goes from 2 per cent to 2.5 per cent and the ALP has said it would only support the Medicare Levy increase for taxpayers on salaries above $87,000..

Also there will be variations on the rules on superannuation contributions which is not based on pension access or the all-important $1.6m super “cap”.

And they will be allowing super to be accessed early whilst previously you could only access super before you retired in cases of extreme financial hardship.

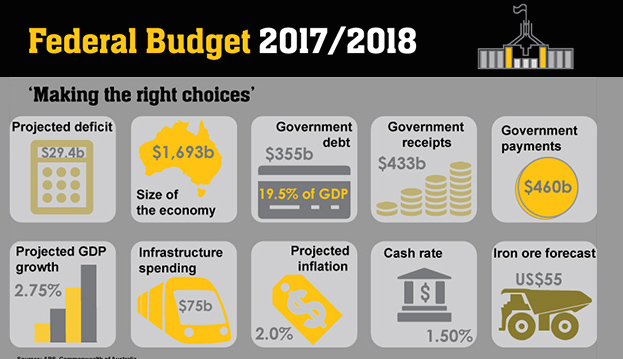

Yes we have seen some great critiques of the latest 2017 budget, which amazingly didn’t leak, but what juicy little morsels were there that effect property investors ?

Property investors will not be allowed to claim travel related expenses which sometimes were used to disguise holidays as dodgy property inspections.

These included of course expenses incurred visiting the property such as flights, rental cars, etc which were all a tax deductible expense.

That was costing the government about $540 million a year !

We believe that many politicians were doing this.

Yes we know the readers of this blog will be surprised at that crazy assertion.

Depreciation deductions for plant and equipment, which were related to investment properties will be cut back as the government tries to drag in another $1.4 billion from property investors, but decided to leave the basic structure of negative gearing alone.

Another approximately $500m will also be extracted from foreign investors with a $5000 flat levy to be paid on foreign owned residential properties which can be shown to have been left vacant for a period of time.

An Orwellian term called the “integrity measure” was created to fund a decent first home buyers’ scheme, which will now allow $30,000 to be salary sacrificed into a superannuation account at the concessional rate.

The maximum contribution is $15,000 a year or $30,000 in total.

This will supposedly enhance the ability of young families, in theory, to build up a virtually tax free deposit.

In reality, in Sydney, it will help you purchase a door..and thats about it.

Crucially, there are also a number of political dimensions to the ultimate delivery of this budget, which must be kept in mind: it has yet to be passed and some compromises on budget details are inevitable in the weeks ahead.

We also noticed depreciation reductions, which continue to exist but they have been “constrained”.

Many property investment owners were using “depreciation scales” to get that extra tax break soon after they purchased a property.

Under an amendment in the budget a new owner of a property cannot get a tax deduction on plant and equipment purchased by a previous owner of the property.

All buyers of new homes must provide identity and pay the tax office the GST bill upfront which can make the whole thing slightly more complex.

Foreign investment restrictions have also been extended so that no new property developments can have more than 50 per cent “foreign ownership”.

Let us have a brief chat about negative and positive gearing.

Most of the time, positive geared property is a high rental return and lower capital growth return whilst a negative investment property tends to be a high capital growth with an “okay” rental return.

If you were looking at the Sydney market the negative gearing will be rubbish if your buying a $900K investment property.

The rental return is about $600 per week and you will be out of pocket about $200 per week.

This is negative cash flow, whilst negative gearing is maximising the tax deductions from your taxable income, but because of the word “negative” people tend to think its negative cash flow.

Which it is before tax, but after tax for about 90% of investors, if they are borrowing off the equity, they are still in pocket about $50 per week.

And thats positive cash flow !

Essentially you have to balance your property portfolio with both negative and positive geared properties because the positive cash flow properties enable you to borrow more money in the future to continue with your long term wealth creation.

Some investors using negative gearing automatically think its negative cash flow.

People can get a 15/15 variation form where they can match their tax deductions to their income payments be it weekly, fortnightly or monthly.

Its always good to get a $7k or $10K cash back from the Government !

This methodology can all be looked at if you are cash flow poor.

This is why we maximise on depreciation with brand new home and land packages in master planned communities that increase the maximum return for tax deductions.

We now know that around 85% of people that have one or more investment properties, fail to claim depreciation because they just don’t know how to maximise their leverage through tax deductions.

“I pay the tax I am required to pay, not a penny more, not a penny less. If anybody in this country doesn’t minimize their tax, they want their heads read because, as a Government, I can tell you they’re not spending it that well that we should be donating extra.”

Kerry Packer

With brand new property you can “use” the first 7-10 years of the property for 2 to 2.5% of the depreciation costs and thats why we focus Australia wide and look at how the market is travelling.

Even when budgets and government are changing, we can still control investing in the right locations and at the right time, with the right Team helping you every step of the way.

Have a chat to us now, to let us show you how we can help you invest in your future.

Or book ahead for our next seminar in May