Why on earth would a company like Ample Property Solutions, which is primarily involved in financial advise and investment strategies create an article about ‘Functional magnetic resonance imaging’ ?

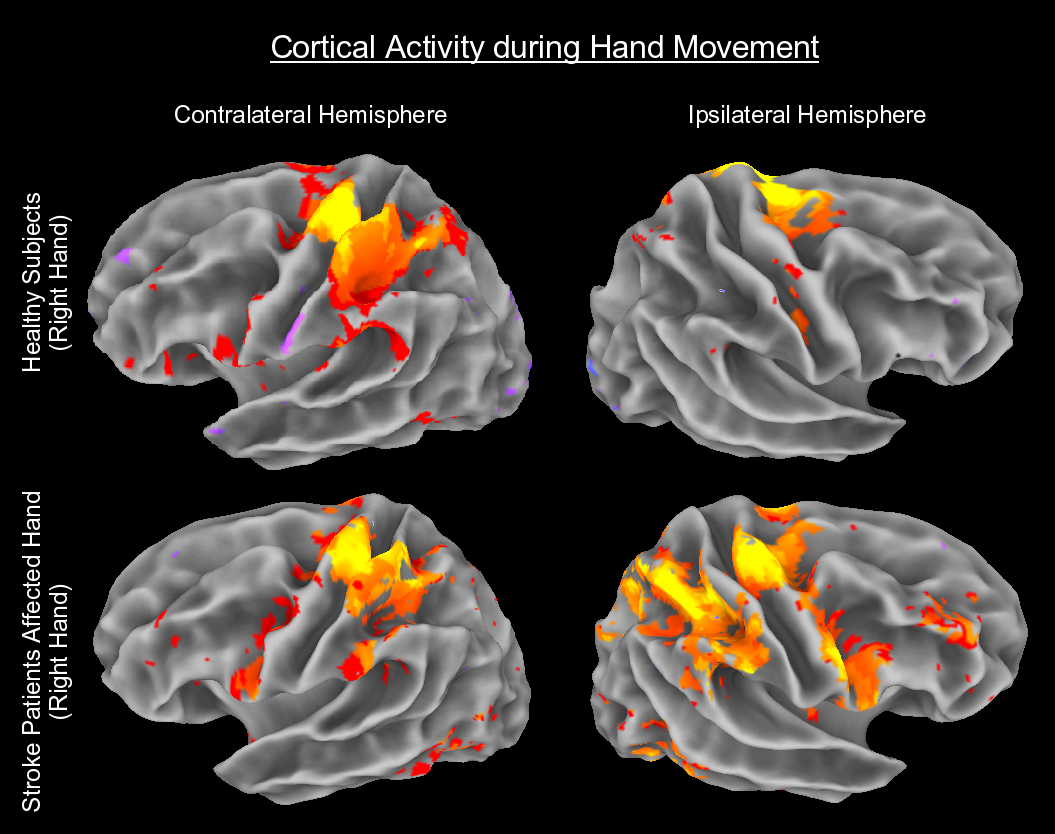

This is a device that measures brain activity by detecting changes associated with blood flow.When an area of the brain is in use, blood flow to that region also increases.

Say what ?

Okay, please hear us out.

There is a phenomena called ‘temporal discounting’ where people value immediate gains, over future gains.

A crack team of psychologists from Stanford University Led by Hal Ersner-Hershfield has done some very interesting research that was related to the disconnect people feel about their actions now, and the results of their actions, on their future self.

The study was built around savings goals.

Of course Ample Property Solutions has consistently argued that investing in property, the right way, was more advantageous than mere saving money and watchings its value depreciate.

But this studies findings were applicable in regards to future planning !

Talking to people about their future had little effect on their savings, but brief exposure to aged images of the self can change that behavior.

Hal Hershfield ran MRI scans on subjects and found that the neural patterns seen when they described themselves 10 years in the future were markedly different from those seen when they described their current selves.

People whose brain activity changed the most when they began discussing their future selves were the least likely to favor large long-term gains over small immediate ones.

However, in follow-up experiments, when subjects were shown aged images of themselves, that tendency disappeared.

The authors were trying to see if we can help people to get to know and show more regard for their future selves, by the exposure to digitally altered aged photos.

Software was used to create digital avatars, half of which were aged with jowls, bags under the eyes, and gray hair.

Then, whilst wearing goggles and sensors, participants explored a virtual environment and came to a mirror that reflected either their current-self or future-self avatar.

How amazing is that ?

Subjects were then asked to use $1,000 to either buy a present for someone, plan a fun event, invest in a retirement fund or place money into a cheque account.

Now the kicker in this research was that the subjects exposed to their aged avatars, invested nearly double their funds, into a retirement fund, than the control group who were not exposed to the digitally altered avatars.

As an added twist, another experiment was carried out and this time the subjects were shown the aged avatars of other people, but not themselves, to see if this effected their choices.

It had no effect.

The subjects that only viewed their future selves, had a greater probability to avoid short term “rewards” and favour long term rewards.

These results are so impressive that Merrill Lynch Wealth Management, a division of Bank of America is using aspects of this technology.

The authors then continued their research using the same technology into ethics and the possibilities of modifying the behaviour of juvenile delinquents.

Welcome to a brave new world.

Rather than telling people to “just invest” and that`s the end, we actually show our clients how to invest wisely for their futures, using property as a wealth creation vehicle.

We actually do care about their financial future.

Their financial future is a shared future..with us !

Does this mean that we, as service providers will one day be using some form of virtual reality and image manipulation to “scare” people into making sensible decisions now, for the future of their families.

Possibly.

But we are sure that it would be an experience that few of our future clients would forget quickly. 🙂