The introduction of the significant investment visa (SIV) the 888, nicknamed the ‘Golden Ticket’ by some investors, is also allowing investors to invest in unlisted managed funds. These funds are known to hold property assets all over Australia. Part of the 888 application states “Visa applicants do not need to satisfy the innovation points test and there are no upper age limits…” Which is very attractive to rich older applicants.

From just a legal perspective, Australian property provides higher returns because when you buy a residency in Australia, you purchase the fee simple estate(a form of freehold ownership) which means your interest in the land exists indefinitely and can therefore be easily be passed on to your heirs.

By contrast, the Chinese system only allows for 99-year lease`s supplied from the government, which means property cannot be purchased outright. This leads to concerns about the finite returns an investor can have in a their local property market. Also plots of land in Australia are on average larger than those in Singapore for example.

Luckily for us , China is experiencing a massive growth (of high earners)in its upper class, who are of course looking for high-yielding and safe property investments. The most important reason for Australia being the destination of choice is stability, especially with memories of Irish and US housing market crashes. Asian developers have also claimed the Asian property market is way too volatile, especially in Hong Kong.

Australia`s major banks tightened funding to foreigners in 2016 due to higher credit risks, causing a brief lowering of offshore demand. But why are overseas investors from Asian powerhouses like China, wanting to invest in places like Sydney for instance ?

A short drive from downtown Shanghai is a suburb called Putuo. Amongst bland tower blocks, a three bedroom off-the-plan apartment of just 98 square metres is on the market for 9.1 million yuan. That’s $1.74 million in a city where the average wage is still only $1215 a month. Credit Suisse research show medium apartment prices in Beijing, Shanghai as well as Shenzhen were all around 15 per cent higher than those in Sydney and 50 per cent higher than Melbourne.

And rental yields in Sydney and Melbourne were double that of China’s three most expensive cities ! This is not even taking into consideration “minor” things like quality of life, air quality, and parks and beaches. Finding out which types of investors are buying or selling is not an easy process, with brokers wary of revealing their clients’ activities.

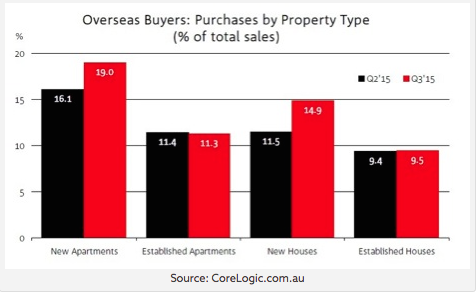

But it is useful as a way of understanding the dynamics of market moves, particularly the rally in the banks since the US election. Australia’s real estate season has seen a massive return of Chinese buyers, undaunted by the recent lending restrictions which were aimed at curbing some of their acquisitions in Australia`s sky-rocketing housing market.

Real estate agents say Asian investors appear to have found new avenues to re-enter the Australian market by purchasing cheaper homes and paying in cash. “Because Australian banks now have stricter lending requirements, Chinese buyers would seek loans from domestic branches of Chinese banks, and also Chinese private institutions, which charge a much higher interest rate,” Long Yi Hao, Longshi Group

Do we need foreign investment ?

The main objective of Australia’s policy on foreign investment in residential real estate is to increase the supply of new housing. Property development, especially inner CBD off-the-plan projects, has helped our construction industry which stepped in to help our economy as the mining boom faded. Without foreign investment, many new building projects simply would never have been built as they were not financially viable for Australian developers.

Foreign investment is adding to the supply of new housing and increases the supply of rental properties. The Australian farm register, compiled by the Australian Tax Office, shows 13.6 per cent of Australia’s farmland is foreign-owned. UK-based investors own 27.5 million hectares or almost 53 per cent of that portion. “With more than $3 trillion worth of foreign investment in Australia today, we cannot afford to risk our economic future by engaging in protectionism.” Treasurer Scott Morrison.

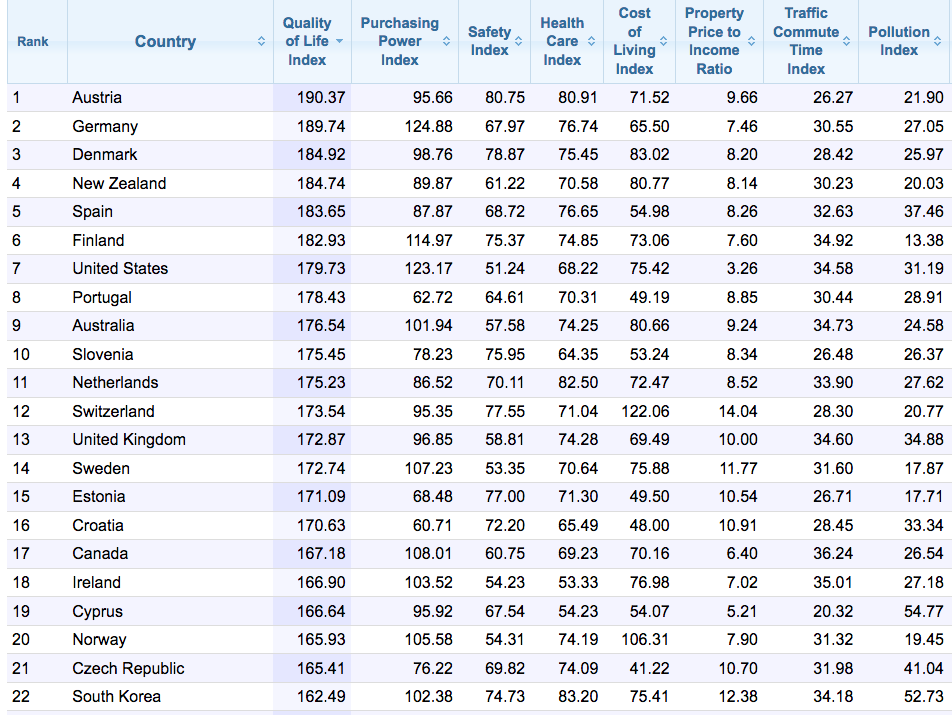

And last but not least, Quality of Life Index for Country 2017. source

So, whats it mean to the average punter in Australia ?

Lets start with a short, but poignant anecdote from Mr Joe Dirani, the owner of Ample Property Solutions. Whilst travelling with a Uber driver the other night, Joe`s driver told him, that he has enough equity for an investment property, but was putting off investing for at least five years, to see how the market moved.

Joe pointed out that there was no time like the present.

Tomorrow may be too late !

If overseas investors find our warm shores so attractive to invest in right now, why would anyone who could invest now, wait ?

And there is no point trying to do the research by yourself.

You need a team behind you. Our Team !

The answer is obvious.

Now is the best time, the right time, to speak to us about your families future.

We have the right team to help you every step of the way.