Wealth is determined by taking the total market value of all physical and intangible assets owned, then subtracting all debts.Essentially, wealth is the accumulation of resources.

We all desire wealth to different degree`s.

Of course the mere pursuit of collecting things that are useless..as a display of wealth, or wasting away of wealth is counter productive.

“Too many people spend money they earned..to buy things they don’t want..to impress people that they don’t like” –Will Rogers

But I am also attracted to a quote from a stoic philosopher, born a slave.

“Wealth consists not in having great possessions, but in having few wants.”

Epictetus AD 55 – 135.

Epictetus

Ample property believes in the saying “Get rich slow, or get poor fast”

If you are after get rich schemes, then your on the wrong site.

We believe the safest way to long term wealth creation is through the power of new property acquisition.

Coupled with the tax advantages as well as debt reducing benefits of investing in new properties in the right locations and at the right time.

Many of us had the mantra pushed into us at a young age that we “must save to get ahead” and initially this maxim is true.

But, and there is always a but, its not a long term methodology that will get you ahead.

Lets examine why.

Saving-Short term ready to go.Great for short term goals like a holiday.Good for goals less than five years.

Investing-Long term goals for more than five years.A major goal like an investment property.

Savings-Easy ability to access cash when needed.

Investing-Obviously harder to access your money.

Savings-Minimal risk deposited in banks in most western countries.

Investment-Always involves an element of risk hence the greater chance of reward.

Savings-Earning interest on your money

Investment-Have a greater probability of higher returns than mere savings due to multiple factors including asset appreciation, tax offsets etc.

The tax offset system we use at Ample property uses new properties for long term wealth creation.This is where the wealth is created, beside the increase in value of the property itself !

But let us look a little closer at savings.

When interest rates fall, the impact on cash investments has a cumulative effect over time.

It does not matter if you are saving towards a goal or you are a retiree who depends on your savings to draw an income, a reduction in cash rates will have an adverse effect on your financial situation.

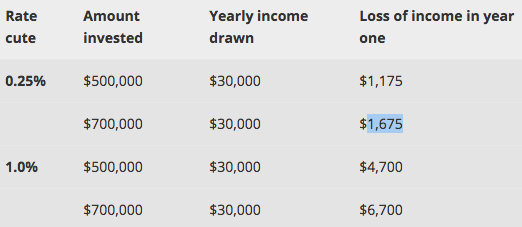

As the following chart shows, if you have savings of $500,000 invested in cash, and you draw an annual income of $30,000 from these savings, a 0.25% per annum rate drop would mean a loss of income of $1,175 in the first year, or 4% of your annual income.

And this is being kind by not talking about how much the true value of your savings/ wealth, is being eaten up by inflation.

Which naturally leads to the second part of this article.The positive results which are accumulated from small steps, into a positive compound effect.These small steps are often boring, or demanding.

Like making that phone call you did not want to make since you were intimidated from previous efforts or another meeting which you want to avoid.

These type of small “advantageous” steps, heading towards a goal have the highest probability of success, rather than trying to rely one “one big break”.

That might come, but the best chance of it happening is through the small steps in the right direction.

Knowledge can be power.

Can..is the defining word in that sentence.

How many broke geniuses are out there ?

Its not what you know, it what you DO with what you know !

This basically requires an action plan, to fulfil your potential.

Most people are too afraid to set goals for themselves, let alone trying to achieve these goals.

A good place to start is the root control factor that governs all your outcomes.

Choices determine the whole life experience.

To change our trajectory in life we have to change our choices.

Simple eh ?

The secret is, small seemingly insignificant moment to moment choices.

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” ― Albert Einstein

But compound choices, are the eight wonder of the success world.

The traps that lay in wait for you are..

1/Invisible results initially.

2/Procrastination, there is always something else you would rather be doing.

3/You might not end up exactly where you thought you would.

4/The desire for immediate gratification.

We are responsible for our lives for what we do, what we don’t do, and how we respond to what has been done to us.

At Ample Property Solutions, we show people how they can make real changes to their lives, by following a simple process, which leads to wealth, true wealth, in the long term.

We do this by utilising the power of property.

Other peoples time and skills combined with other peoples money(the banks) leads to our future wealth.

Now is the time to make a booking. HERE

And you can book for our next free seminar HERE

“We must all suffer from one of two pains: the pain of discipline or the pain of regret. The difference is discipline weighs ounces while regret weighs tons.” ― Jim Rohn